Divergence happens when the direction that the prices of an asset and of technical indicators are in opposite ways. Divergence between price, momentum indicators such as the RSI/MACD can be useful in identifying potential modifications to the price of an asset. This is why it is the foundation of numerous trading strategies. We are excited to inform you that you can now utilize divergence to establish closing and open conditions for your trading strategies by using cleo.finance! Read the most popular automated forex trading for more tips including fbs copy trade minimum deposit, xtb mt4, trader fx, intraday automated trading, metaquotes demo, oanda spreads, best international crypto exchange, cryptos on robinhood, ic markets spreads, robot trading system, and more.

There Are Four Main Types:

Bullish Divergence

Price is printing lower low and the technical indicator is showing higher lows. This suggests a weakening of the downtrend's momentum and an eventual reversal to upside.

Hidden Bullish Divergence

The oscillator is making lower lows and it has higher lows. A hidden bullish divergence could indicate that an uptrend is continuing. It can be seen in the top or the tail of a price throwback which is also known as the retracement down.

Hidden Bullish Divergence explanation

Quick Notes

Bearish Divergence

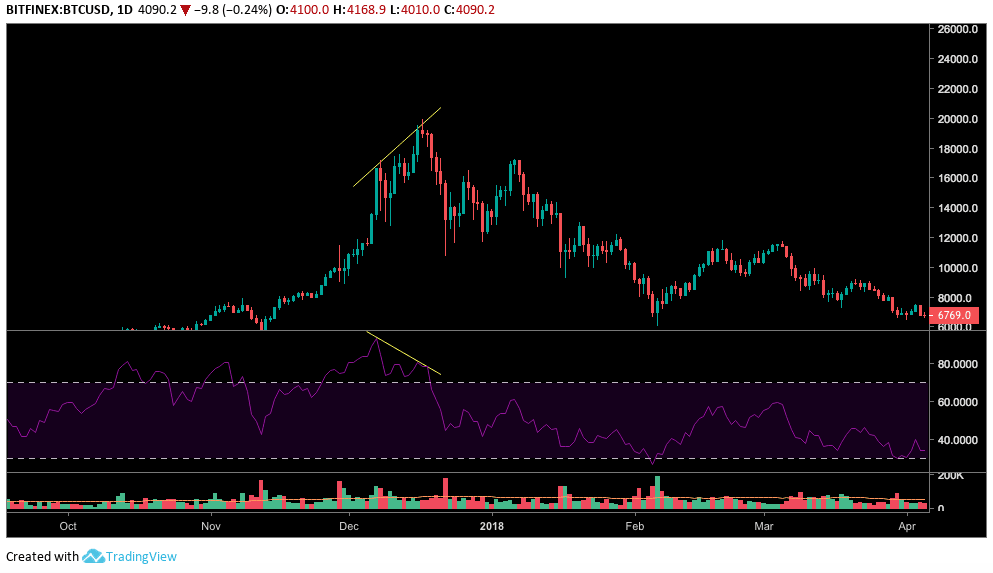

The price has been making higher highs, and the technical indicator is showing lower levels. This means that the momentum for the upside is decreasing and there could be a reversal of the trend to the downside.

Bearish Divergence Explanation

Quick Notes In the event that the indicator is in an upward trend and the peak is visible then it will be moving down first.

Hidden Bearish Divergence

The oscillator has higher highs, and the price is making lower lows. An invisible bearish divergence, which can indicate that the downtrend will last and will continue, is evident at the an end of an upward pullback (retracement back).

Hidden Bearish Divergence Explanation

Quick Notes - Prices drop at first when a peak can be seen in a downtrend.

Regular divergences provide a reversal signal

Regular divergences can be powerful indications that a trend change is likely to occur. They are an indicator that the trend may be indeed strong but it has lost momentum and can signal a possible shift in direction. Divergences may be powerful entry triggers. Check out the best RSI divergence cheat sheet for blog advice including we fund traders, algorithmic trading strategies, morpher crypto, forex system, best metatrader 4 expert advisor, currency exchange trading, crypto forex investment, algo trading wazirx, etoro crypto list, cheapest crypto exchange fees, and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences can be continuation signals that happen just in the middle of an ongoing trend. Hidden divergences are signals of continuation which indicate that the trend is likely to continue following a pullback. They can also be powerful entry triggers, especially when confluence is present. Traders use hidden divergences to join in with the current trend after the pullback.

Validity Of The Divergence

A momentum indicator such as RSI and Awesome oscillator is the best way to measure divergence. These indicators focus on current momentum, and therefore trying to map out the divergence of 100+ candles ago does not have any value in terms of predictive power. The date of the indicator's change can affect the look-back range necessary for valid divergence. Make sure to use discretion when determining the legitimacy of the divergence. Some divergences are not valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Have a look at the most popular trading platforms for blog info including cryptocurrency margin trading, semi automated trading software, most popular forex pairs, crypto currency exchanges, strategy alerts tradingview, top 3 crypto exchanges, most successful crypto traders, coinbase trading, citiforex, binance auto sell and buy, and you can compare those divergences between two points:

Price With An Oscillator Indicator

A combination of an oscillator indicator as well as another indicator. Price of any asset along with any other asset.

This guide will show you how to utilize divergences in cleo.finance-builder

Hidden Bullish Divergence in Cleo.finance helps to create an open environment

Customizable Parameters

Each divergences has four variables that traders can edit. can further customize their strategies for divergence to suit optimal:

Lookback Range (Period)

This parameter specifies how far back should strategy search for the divergence. The default value is 60. This signifies "Look for the divergence at any time within the last sixty bars."

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter specifies the number of candles that on the left side are needed to confirm that the pivot point is located.

Confirmation bars (Pivot Lookback Right)

This parameter determines how many bars are required to confirm that the pivot points have been found. Take a look at recommended crypto trading backtester for site tips including divergence rsi indicator mt4, udemy crypto trading, hugosway leverage, metatrader 4 online, best broker for forex trading, mt4 software, day trade crypto robinhood, intraday crypto trading, goldman sachs automated trading, trading bot system, and more.

Timeframe

It is possible to define the timeframe within which the divergence should be observed. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Parameters for Divergences settings on cleo.finance

The pivot point settings determine the point at which each divergence reaches its peak. It is possible to keep the default settings to create the bullish divergence.

Lookback The range is 60

Min. distance between troughs (left) = 1

Confirmation bars = 3

This setting means that both troughs within the divergence should be the lowest point within the nearest 5 bars (lower than one bar to the left and three bars to the right). This is true for both troughs within the 60-day lookback period. This divergence can be confirmed by three bars after the closest pivot points were found.

Available Divergencies In Cleo.Finance

They are typically employed in conjunction together with RSI Divergence as well as MACD Divergence. However any other oscillator can be evaluated and live tradeable using the trading automation platform cleo.finance. See the top RSI divergence cheat sheet for site examples including trading binance bot, ftmo mt4, ftmo leverage, rsi divergence indicator mq4, auto trading software, top rated forex brokers, mrg forex, interactive brokers robot trading, binance algo trading, fbs mt4, and more.

In Summary

Divergences can be an effective instrument for traders, however they must be used with care and with a plan. This will help traders make better informed decisions when trading using divergences. A systematic and disciplined method of analyzing divergences is vital. Combining them with other fundamental and technical analysis, like Fib Retracements, or Support and Resistance lines, only increases the credibility of the validity of the divergence. Learn more about our Risk Management guides on position sizing and stop loss placement. You can instantly start creating optimal divergence strategies with the help of over 55 technical indicator, price action, candle sticks data points and more! The cleo.finance platform is continuously being improved. Let us know whether you have a requirement for an indicator of data, a data point, or any other information.