Automated cryptocurrency trading refers the use of computer programs or algorithms that execute trades on the crypto market. These programs are programmed to adhere to specific trading regulations with the intention of maximising profits and minimising losses.

It is crucial to select an automated trading platform that you can trust: There are many trading platforms on the market. It is essential to select an option that is reliable, has a solid history and is compatible with your trading requirements.

Develop a trading plan. Before you can begin automatized trading, it is crucial to have a clear trading plan. This involves determining the market conditions where you'd like to trade, making a decision on entry points and exit points, and setting stop loss orders.

Management of risk: In order to limit losses, an automated trading system must include an effective risk management system. This includes setting stop-loss and limit trades.

Before you use your strategy for live trading, it is important to test it on previous data. This will enable you to find and fix any weaknesses in your strategy.

Monitor the automated trading system. Automated trades are time-saving, but it is essential to monitor it regularly to ensure that it's working correctly.

Keep current with market conditions. If you wish to achieve success in the automated trading of cryptocurrency It is essential that your strategy be constantly kept up to date.

Diversified portfolios are a smart idea. The cryptocurrency market can be volatile. To spread out the risk and maximize potential gains, it is beneficial to include a range of currencies and investments within your portfolio.

A successful automated crypto trading strategy requires an efficient software system, a developed trading strategy, effective risk management, continual monitoring and adjustments, and taking into account a variety of portfolios. Check out the top automated trading software tips for site tips including top 20 crypto exchanges, auto trading bot forex, automated stock trading systems, best automated trading platform, bitsgap app, phemex crypto exchange, new crypto exchange, automated online trading platform, best robot trader software, auto trading crypto, and more.

What Tools For Backtesting Forex Are Available And How To Use Them?

There are many options for forex backtesting, each with their specific capabilities. MetaTrader 4 & 5: MetaTrader 4, a well-known forex trading platform, includes a built in strategy tester that allows you to test strategies for trading back. It allows traders to analyze the past to improve settings and test their strategies.

TradingView: This website-based charting and analytics platform has backtesting capabilities. It allows traders to experiment with and develop strategies with their Pine Script programming language.

Forex Tester Forex Tester is a separate software designed for backtesting forex trading strategies. It comes with a range of analysis and testing tools. It can also simulate various market conditions to test multiple strategies at once.

QuantConnect: A cloud-based platform that allows traders backtest forex strategies and other trading strategies using a variety of programming languages including C#, Python and F#.

These steps will help you to make the most of forex backtesting software.

Determine your trading strategy. This could include indicators that are technical chart patterns, chart patterns, or other criteria.

You can now set up the backtest using the program you like best. This usually involves selecting the currency pair to be traded, the period to be tested, and other parameters.

To see the performance of your strategy in the past, you can run the backtest. The backtesting software will generate a report that shows the results of your trades including profit and loss, win/loss ratio, and other performance metrics.

Analyze the results: After having run the backtest, can review the results to see how your strategy performed. The results of the backtest can help you to modify your strategy to improve its performance.

Forward-testing the strategy: Once you've made any changes to your strategy you can test it out using the demo account or some real money. You'll be able see how it performs in real-time trading conditions.

Forex backtesting software lets you gain invaluable insight into the effectiveness of your strategy over time. This information can be utilized to enhance your trading strategies going ahead. See the top forex backtesting software free url for blog tips including auto signals binary, automated forex signals, robinhood automated investing, best crypto day trading platform, forex trading chat room, forex algorithmic trading strategies, best coin trading platform, auto buy sell trading software, world forex forum, automated swing trading, and more.

What Are The Primary Factors That Contribute To Rsi Divergence

Definition: RSI diversence is a technique that studies the direction of an asset's price change and the relative strength of its index (RSI). Types: There are two types of RSI Divergence The two types are regular divergence and hidden divergence.

Regular Divergence - This occurs when the value of the asset has higher or lower bottom, while the RSI has lower highs or a lower low. It may indicate a possibility of trend reversal, however it is essential to look at the other factors, both fundamental and technical, to confirm.

Hidden Divergence: This occurs the case when an asset's price makes a lower or higher low, while its RSI shows an upper or lower low. This is not as clear as normal divergence, but it can be an indication of an inverse trend.

Considerations regarding technical aspects:

Trend lines, support/resistance levels and trend lines

Volume levels

Moving averages

Other oscillators, technical indicators

Think about these basic factors:

Release of economic data

Information specific to businesses

Sentiment indicators for the market

Global and global market events and their impact

Before you make investments based on RSI divergence signals , you need to examine both technical and fundamental factors.

Signal Positive RSI diversification is considered to be a positive signal for bulls. If it is negative, RSI diversification is considered to be bearish.

Trend Reversal - RSI diversification is an indication of a possible trend reverse.

Confirmation: RSI divergence can be used as a confirmation tool in conjunction with other analysis methods.

Timeframe: RSI Divergence can be observed in different timeframes to gain different perspectives.

Overbought/Oversold: RSI values above 70 indicate overbought conditions, and values lower than 30 indicate that the market is oversold.

Interpretation: To interpret RSI divergence in a correct manner requires consideration of other technical and fundamental factors. See the most popular helpful resources for blog tips including bitsgap app, cryptocurrency margin trading, ats automated trading system, day trading automation software, investing in cryptocurrency on etoro, crypto day trading platform, algo trading metatrader 5, automated stock buying selling program, gemini exchange reddit, robot trading software, and more.

How Do You Analyze The Results Of Backtesting To Determine If A Trading Strategy Is Risky Or Profitable?

Backtesting backtests is an essential process to determine whether an investment strategy is risky and profitable. Here are some tips to analyse backtesting results Perform performance indicators The first step when analysing results of backtesting. You need to calculate performance metrics, such as the total and average returns, the maximum drawdown, and Sharpe ratio. These indicators provide information about the risk and profitability associated with the trading strategy.

Comparing with benchmarks. Comparing the benchmarks and performance indicators (e.g. the S&P 500) can be an excellent reference point to see how the strategy has performed relative to the other markets.

Evaluate risk management techniques Examine the risk management strategies that are employed within the trading strategy, such as stop loss orders, or positioning sizing to evaluate their effectiveness in reducing risk.

It is essential to be aware of patterns or trends. Examine the strategy's performance at a regular interval to identify patterns or trends. This can help you determine areas that might require adjustment.

Take into consideration market conditions: Think about the market conditions in the backtesting phase, such as volatility or liquidity. You can then evaluate the performance of the strategy in various market environments.

Backtest the strategy with various parameters: To determine the strategy's performance in different circumstances, test the strategy using different parameters.

Modify the strategy as needed Based on the findings of the backtesting analysis, alter the strategy if necessary to enhance its effectiveness and lower risk.

Backtesting data analysis requires a careful review of performance metrics , as well as risk management techniques as well as market conditions. These factors could affect the profitability and risk of a trading strategy. When taking the time to thoroughly review backtesting results, traders can identify areas for improvement and adjust their strategy accordingly. Read the recommended trading platform blog for blog info including poloniex auto trader, best platform to buy crypto, best stock trading message board, automated forex trading, cryptocurrency platforms usa, best crypto exchange with low fees, crypto investing app, best trading crypto, trading in binance, best crypto traders to follow, and more.

What Are The Major Differences Among Cryptocurrency Trading Platforms Online?

There are many differentiators between the various online cryptocurrency trading platforms. These include Security: One of the most important differences between cryptocurrency trading platforms is the degree of security they offer. While some platforms have stronger security measures like two-factor authentication, or cold storage, other platforms might have weaker security measures and are more vulnerable to hacking and theft.

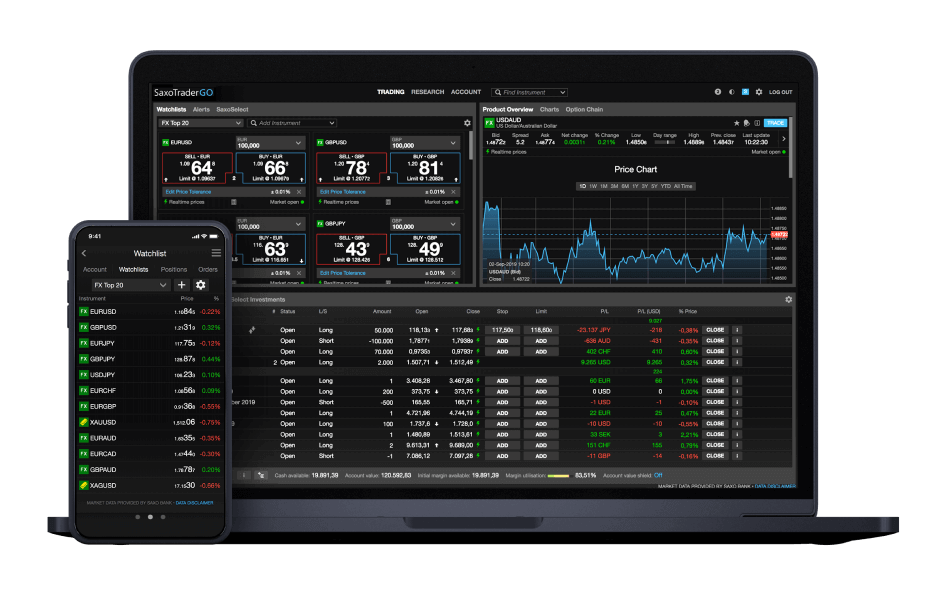

User Interface: There are many choices for the user interface on a cryptocurrency trading platform. It could be simple and simple to complex and challenging to navigate. Some platforms have more advanced tools and features, while others are more targeted at beginners.

Trading Fees: There are numerous differences between the different cryptocurrency trading platforms. Some platforms charge higher fees for trading, while others may offer lower fees for exchange of a smaller trading pair or with more advanced trading features.

Supported Trading platforms might support various cryptocurrencies that can affect the options for trading available to customers. Certain platforms can offer more cryptocurrency than other platforms. Some platforms may support only a an insignificant number of the most commonly used cryptos.

Regulation: Each platform could have different levels of regulation or oversight. While some platforms may have more regulation, other platforms operate with less supervision.

Customer Support: The degree and the quality of customer service will also differ between trading platforms. Some platforms offer 24/7 customer support via phone or live chat, while others may only offer email support or have only a limited number of hours for support.

There are a variety of key differences among online cryptocurrency trading platforms. They include user interfaces, security trading fees, and the support for cryptocurrencies. Traders should carefully consider these aspects when selecting an online platform to trade, as they can impact the experience of trading and the risk level. View the recommended divergence trading examples for blog advice including the best auto trading robot, auto trading company, simple algorithmic trading strategies, day trader chat rooms, nasdaq automated trading system, etoro cryptocurrency fees, forex beginner reddit, best chat rooms for stock trading, coinbase margin trading, free stock trading forums, and more.

[youtube]RDgu6d5dMGE[/youtube]