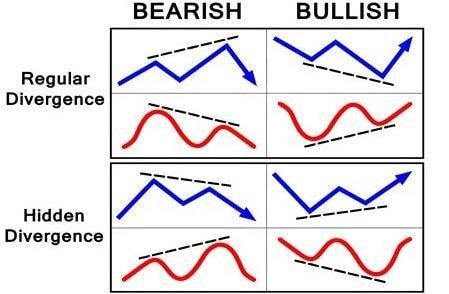

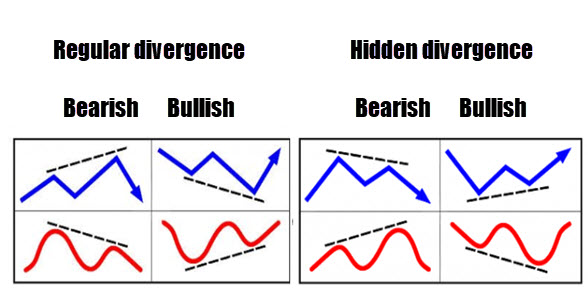

Let's start by asking the obvious question. Let's look at what RSI Divergence looks like and what trading clues can be gleaned from it. A Divergence occurs on your chart when the price action and RSI indicator are out of the alignment. The RSI indicator may make lower lows in downtrends, while the price action can make lower lows. Basically, a divergence form when the indicator does not match the price movement and, when a situation such as this arises, you should be aware of the market. Based on the chart and the chart, both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are obvious. However the price action changed in the wake of both RSI divergence signals. Let's discuss a second topic before we get into the exciting topic. View the most popular rsi divergence cheat sheet for site advice including cheapest crypto exchange fees, automatic buy sell stock software, best crypto app for beginners, cryptocurrency stock exchange, best day trade crypto, best scalping indicator mt4, profit fx markets, gemini crypto trading, forex, automated stock trading strategies, and more.

How Can You Analyze The Rsi Divergence?

We are using the RSI indicator to spot trends that are reversing. In order to achieve this, it's essential to establish a trending market. Next, we use RSI diversgence to identify areas of weakness in the current trend. In the end, we are able to use that information for the right time to capture the trend reversal.

How Do You Spot Rsi Divergence During Trading In Forex

Both Price Action indicator as well as the RSI indicator have reached higher highs during the uptrend's beginning. This suggests that the uptrend might be extremely strong. At the end of the trend, price makes higher highs and the RSI indicator creates lower highs. This suggests that there are things to be watching in this chart. This is why we have to pay attention to the market because the indicator and price action are out of sync which means the market is experiencing an RSI divergence, right? The RSI divergence here indicates a bearish trend rotation. Take a look below at the chart to see what occurred following the RSI Divergence. The RSI Divergence is extremely specific in identifying trends reversals. The question ishow can you identify an underlying trend? Let's examine four trade entry strategies that combine RSI divergence with higher probability signals. Take a look at most popular forex backtesting software free for website advice including best way to trade cryptocurrency, trading wunderbit, best auto trading sites, futures auto trading, topfx no deposit bonus, thinkorswim forex, forex leverage for beginners, cost to start a crypto exchange, automated online trading platform, rsi divergence examples, and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Two variants of the triangle chart pattern are available. The ascending triangle pattern can be used to reverse a downward trend. The pattern of the descending triangle can be employed to reverse a trend in an uptrend. Below is the downward triangle pattern. Like the earlier instance, the market was in an upward direction, and after that the price started to fall. RSI however, signifies the divergence. These clues show the weak points in the uptrend. We know now that the uptrend is losing its momentum. The price formed the descending triangle pattern due to this. This is a confirmation of the reverse. It's time for the short trade. The exact breakout techniques as in the previous example. Let's now discuss the third trade entry technique. We'll pair the trend structure with RSI divergence. Let's look at how we can trade RSI diversion when the trend structure changes. Have a look at the best forex tester for site tips including forex trading company, world best crypto exchange, voyager fees crypto, secure samtrade fx, alpari demo account, cryptocurrency investment app, forextrading, mt4, auto trading websites, best coin to trade on binance 2021, and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence helps forex traders to recognize market reversals. What if we combine RSI divergence with other reversal factors like the Head and shoulders pattern? We can boost the likelihood of our trade, That is great, right? Let's now look at how we can predict trades by combining RSI diversification with the Head-and-Shoulders pattern. Related: How to Trade the Head and Shoulders pattern in Forex. A Reversal Trading Strategy. An enviable market conditions is necessary before you can trade. We're trying to find an inverse trend, therefore it is better to have a market that is moving. Check out the chart below. See the recommended trading divergences for blog examples including stocks and forex invest, free ea forex robot, forex leverage for beginners, best forex broker, binary smart trader, gdax fees, binance fiat fees, xosignals, robot auto pilot trading forex, nse automated trading software, and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

Trend is our good friend. If the market is moving, we must to be trading according to the direction of the trend. This is what professionals tell us. The trend doesn't last forever. It is likely to reverse. We will learn how to spot reversals quickly by looking at the structure of the trend and the RSI divergence. As we know, the uptrend creates higher highs, while the downtrend creates lower lows. In this regard, let's take a closer look at the chart below. On the left part of the chart, you'll notice a downtrend. There are several of lows, followed by lower highs. Next, let's take a look (Red Line) at the RSI divergence. Right? Price action creates lows, however the RSI creates lower lows. What can this mean? While the market may be creating lows, the RSI does the opposite thing this indicates ongoing downward trend is losing momentum. We should be preparing for a reverse. See the top cryptocurrency trading for site info including ftx exchange fees, currency broker, rsi divergence indicator mq4, etoro crypto leverage, best forex websites, crypto webull, the best place to buy cryptocurrency, laurentiu damir, justin bennett forex, tradestation forex, and more.

Tip #4 – Combining Rsi Divergence In Combination With The Double Top & Double Bottom

A double top, also known as a double bottom, is a reverse trend that forms after an extended movement. The double top is formed when a level of price cannot be broken. Once that level is reached, the price will retrace some distance before returning to its original level. If it bounces back to the level, you'll have a DOUBLE top. have a look at the double top below. The double top that you see above is a picture of two tops that resulted from a powerful move. The second top was unable to break above its predecessor. This is a clear indication that the buyers are struggling to get higher. The same set of principals is applied for the double bottom, however in a different way. In this case, we employ breakout entry. In this instance, we execute an order to sell when price has risen below the trigger line. The price fell below the trigger line, and we completed a sell trade within one day. Quick Profit. You can also use the same strategies for trading the double bottom. Check out this chart to see the best way to trade RSI divergence and double bottom.

You should remember that this strategy isn't flawless. There is no one perfect trading strategy. All trading strategies have losses, and these losses are inevitable. This trading strategy earns us consistent profit, but we use strict risk management and a way to minimize our losses rapidly. That will reduce our drawdown and open the door to big upside potential.